Theoretical Framework

"Technological Revolutions: Which Ones, How Many and Why It Matters: A Neo-Schumpeterian View"

2021 Perez, C. and Murray Leach, T. Working Paper – Horizon Project Beyond 4.0 Publications

Table of Contents

Document Summary

Contents

Executive Summary

- Introduction

- Approach to the literature review

2.1 Aims

2.2 A Nota Bene

2.3 Selection criteria

2.4 A note on terms

2.5 Categories

- Different definitions of technological revolutions: what, how many and when

3.1 The cyclical ‘long waves’ approach: the economic view

3.2 The historical view of technological revolutions

3.3 The business and engineering perspective

3.4 The Neo-Marxists

3.5 Innovation-centred: between Marx and Schumpeter

3.6 Technological transitions studied at the meso-level

3.7 The Neo-Schumpeterians: the mutual shaping of technology and society

- Defining technological revolutions from a Neo-Schumpeterian perspective

4.1 The structure of technological revolutions

4.2 The regular pattern of diffusion

4.3 Recurrence of loss and gain: the socio-economic impact of the patterns of installation and deployment

4.4 The role of paradigm shifts in lifestyles in the transformation of jobs and employment

- Adapting to the technologically inevitable or shaping the options through policy?

5.1 Techno-optimist, techno-pessimist – or techno-determinist?

5.2 State and society set the direction for technology

- Industry 4.0 and the five surges model: complementary theories for informed policy

6.1 Areas of coincidence

6.2 Key differences

6.3 Why and how are the approaches complementary?

6.4 A leap ahead with broader and more ambitious policy goals

- Some concluding words

Bibliography

APPENDIX: Findings and reflections of database searches on ‘technological/industrial revolutions’

A.1 Introduction

A.2 Terms and definitions

A.3 Google NGRAM

A.4 Google Books

A.5 Scientific American

A.6 Google Scholar

A.7 Web of Science, other databases and individual journals

Introduction

The BEYOND4.0 project takes its name from Industry 4.0, a term coined at the turn of the last decade to promote the technological upgrading of German industry and popularised by Klaus Schwab (2016) via his leadership of the World Economic Forum. Over the past decade, it has gained significant traction in discussions of technological or industrial revolutions, despite not being well defined (Kowalikova et al., 2020); according to Schwab, it relates to cyber-physical systems, whereas to others, it relates to advanced ICT and/or AI and robotics. Either way, this fourth revolution has been heralded by some as the saviour of our futures while perceived by others – sometimes in tandem, sometimes opposingly – as the cause of job and skill losses, regional declines and further threats ahead.

However, the definition of what makes a technological revolution is not clear and established. Since the mid-eighteenth century, academics and policymakers have been intrigued by repetitive historical patterns of economic growth and decline and the links between these patterns and major shifts in the socio-economic context. For some of those scholars, the influence that technological change has played in these shifts has been a key area of interest. Yet different schools and authors have identified different numbers of revolutions and provided diverging interpretations of their nature and consequences. Whilst there have been some attempts to outline definitive historical periodisations with categorical ‘empirical evidence’ (see Section 3.1), these have not resulted in any watertight conclusions. We hold that it is not actually possible to judge what are, in fact, theoretical frameworks as correct or not, because they are, precisely, theories – and each one focuses on a particular question, or set of questions and goal, and uses a different lens to interpret and slice history.

Thus, what we hope to do with this background paper, a critical survey of the study of the relationship between technological revolutions and economic growth in the industrial era, is not to discuss the validity of the different interpretations, but rather to identify the point of view that leads to each periodisation. The goal is to broaden our understanding of the notion of technological or industrial revolutions, and to consider the impact that different approaches have on the application of history to our understanding of the present and the future. We argue that ultimately there are clear advantages to complementing Schwab’s concept of Industry 4.0 with a neo-Schumpeterian interpretation; one which emphasises the role the State and wider society can play in shaping technological progress, specifically when it comes to policy design in relation to skills, employment and their relationship to social wellbeing.

The paper is laid out as follows. Section One is a discussion of our approach to the literature review and a brief description and summary of the broader literature and popular discourse survey work that was done for Task 7.1, the detailed findings of which can be found in the extensive Appendix to this paper.

Section Two is a detailed summary of the key contributions. The interpretations of economists studying growth – Kondratiev, Schumpeter, Kuznets, Maddison and others – are contrasted with the periodisations made by economic historians – Landes, Mokyr – and by those focused on the consequences of technical change – R. Gordon, Frey and Osborne. We also cover the input of Marxist scholars – Hobsbawm, D. Gordon, Bowles; of those concerned primarily with socio-technical transition processes – Geels et al.; and the analyses and predictions of the future of technology focused on the worlds of management and engineering, such as Brynjolfsson and McAfee, Schwab and others.

Section Three is a summary of the neo-Schumpeterian approach and includes a detailed primer on the dating and content of each technological revolution: the associated raw materials, general-purpose technologies, infrastructures, and organisational forms; the periods of installation, bust and boom; and the defining ‘lifestyle’ that has aided in the positive-sum deployment of the new technologies for business and society.

In Section Four, the paper argues that the differences in interpretation stem from the focus and premises adopted by each author and from the types of interactions studied and highlighted, with a particular warning regarding the tendency towards technological determinism and the importance of understanding the role of society in shaping the direction and diffusion of technology.

Finally, Section Five compares the Schwab and Neo-Schumpeterian approach, concluding that they are complementary. The paper holds that the way revolutions are defined leads to different policy implications, and that is why the interrogation of theoretical notions is crucial; our primary objective will be to compare the way that each of the models understands the nature of the revolution and the power of society to mould it, believing that understanding defines the capacity to guide policy action effectively.

Concluding Words

The current popularity of the notion that we are in the midst of a ‘Fourth Industrial Revolution’ comes at a time when the growing inequality characterising the past few decades has become evermore unacceptable and its reversal evermore urgent. The COVID-19 pandemic has not only increased that sense of urgency, but also brought into focus the role of innovation in solving major problems such as global health – and the power of governments to both foster that innovation and support the economy in multiple ways.

In these circumstances, the role of technology, as a set of tools that can both solve existing problems – such as unemployment, environmental damage and global inequality – and create similar problems of its own is being increasingly recognised. In particular, the answers to the questions of its degree of inevitability, of its possible or negative effects and of society’s capacity or incapacity to shape it for the common good, are becoming essential. All too often, the pronouncements that we are in a technological revolution come both without critical interrogation, and with an underlying bias toward technological determinism.

In this paper, we have tried to map the various avenues pursued by scholars of technological evolution, from the ones who see it dimly as the possible cause of major economic fluctuations, through those who focus on one or another of the particular changes it produces – be it in politics, society, work, production practices or employment – to those who emphasise the mutual influence between technology and society. We have tried to illustrate how the different framings can lead to different understandings of how best to act now. It is our contention that the neo-Schumpeterian identification of the recurring historical pattern in the propagation of technological revolutions and the role played in each period by finance, production, politics and government policy is particularly useful for identifying the opportunities for social shaping. At the same time, the understanding of the processes provided by the Dutch transitions school can illuminate the types of action and the roles played by the different actors in each of the sectors. In addition, a useful method for guiding the actual process of change is the work of Mariana Mazzucato on the use of ‘missions’, a practice that can be adopted by governments to bring together the action of multiple agents in society all focused on achieving one after another of the desired goals (Mazzucato, 2021).

Armed with this deeper understanding, the route to a better future can be helped by the many scholars who are taking up the Industry 4.0 framing to analyse the specific risks and promises of the frontier technologies in each of the areas where they influence change. A technological revolution is a massive process of change across society, affecting and affected by everything from geopolitics to lifestyles. Understanding the way such changes have been faced historically is likely to increase the chances of success in overcoming the major threats confronting humanity today, and in building a socially and environmentally sustainable world.

“Capitalism, Technology and a Green Global Golden Age: The Role of History in Helping to Shape the Future”

Perez C. (2016 ) In Mazzucato and Jacobs eds. Rethinking Capitalism London: Wiley Blackwell Ch. 11 pp. 191-217.

Table of Contents

2.1 The history of technological revolutions

2.2 A regular pattern of diffusion

2.3 Why we are now in the equivalent of the 1930s and 40s

3.1 A very broad definition of ‘green growth’

3.2 A shift in consumer demand

4.1 The quality and profile of domestic and global demand

4.2 New sources of employment growth

4.3 Pendular shifts in income distribution

5.1 A mental paradigm shift

5.2 Policy-making in the Deployment Period

5.3 A clear socio-political choice

Introduction

“From long waves to great surges: continuing in the direction of Chris Freeman’s 1997 lecture on Schumpeter’s business cycles”

(2015) European Journal of Economic and Social Systems, Volume 27 – N° 1-2, pp. 69-79

Abstract

• Schumpeter’s “Business Cycles” Revisited

Christopher FREEMAN · pp.47-67

• From Long Waves to Great Surges

Carlota PEREZ · pp.70-80

"Unleashing a golden age after the financial collapse: Drawing lessons from history"

2013. “Unleashing a golden age after the financial collapse: Drawing lessons from history” in Environmental Innovations and Societal Transitions, Vol. 6, March, pp. 9-23

Download Text

Abstract

The current crisis is not a “black swan” but a recurrent historical event midway along the successive technological revolutions. In contrast with other crises, the ones that follow the major technology bubbles install a vast innovation potential that can be unleashed with adequate government policies. The so-called Golden Ages in the past two centuries (the Victorian boom, the Belle Époque, the post war golden age) have followed post-bubble recessions. After governments save the banks and jump-start the economy, they need to regulate and reorient finance towards the real economy while fostering synergistic growth in agreed directions. The article holds that the possibility is there for unleashing a golden age – national and global – by tilting the playing field in favor of “green growth”. The question is whether the conditions for government to become proactive again are as favorable as after WWII.

Keywords

Financial bubbles, golden ages, great surges, green growth, industrial policy, techno-economic paradigms, technological revolutions

Highlights

- The current post-bubble recession is more akin to that of the 1930s than to that of the 1980s.

- Economic revival requires the equivalent of the Welfare State, Bretton Woods and the New Deal to unleash innovation and investment.

- To be effective, the regulation of globalized finance must be supranational and overcome opacity.

- “Green growth” is not only for saving the planet but is probably the most effective route to saving the economy.

- The conditions in favor of active State intervention to shape markets are not yet ripe but there are several growing trends pointing in that direction.

Table of Contents

- Introduction

- Not a “black swan”: the historical recurrence of bubbles and crises

- Three steps out of the post-bubble collapse

Emergency action to save the patient

An adequate institutional framework for global finance

Creating conditions to guide synergistic growth - Overcoming the crisis by tilting the playing field to redirect innovation

- Are the socio-political conditions favorable to unleashing the next golden age?

List of Figures

- The historical record: different prosperities on either side of the financial collapse

- Pendular polarization of income along each Great Surge of Development in capitalism

"Financial bubbles, crises and the role of government in unleashing golden ages"

2013. In Pyka, A. and Burghof, H.P. (eds.) (2013) Innovation and Finance. London: Routledge, Ch.2, pp. 11-25

Abstract

Table of Contents

- The recurring pattern and its causes

- The process that leads to the major technology bubble

- The double bubble at the turn of the Century

- From Installation to Deployment

- A global sustainable golden age ahead?

"The financial crisis and the future of innovation: A view of technical change with the aid of history"

2011. In van Tilburg et al. (Eds), Let finance follow and flow: Essays on finance and innovation, The Hague: AWT

WP: February 2010. Working Papers in Technology Governance and Economic Dynamics, No. 28, Tallinn University of Technology, Estonia, and The Other Canon Foundation, Norway

Table of Contents

1. Great Surges of Development: Two different periods in the propagation of technological revolutions and their paradigm

The Turning Point and the need for institutional innovation

Installation and Deployment: different drivers of innovation

The hyper-segmentation of markets: differentiation and adaptability

The hyper-segmentation of production units: networks and specialisation

The shaping power of the energy and environmental challenges

The coming redesign of globalisation

The gestation of the next revolution

The implicit innovation policies

The direct policies: innovating in the financing of innovation

KIEs, SMEs and networks

Recognising intangible value

Providing continuity of support along the life-cycle

The roles of R&D in the present and for the future

4. Conclusion

References

Summary

This essay locates the current financial crisis and its consequences in a historical context. It briefly outlines the difference in patterns of innovation between the first two or three decades of each technological revolution -regularly ending in a major financial collapse- and the next two or three decades of diffusion, until maturity is reached. With this historical experience in mind, the essay discusses the opportunity space for innovation across the production spectrum taking into account the specificity of the Information and Communications Technology (ICT) paradigm and the increasing social and environmental pressures in the context of a global economy. Finally, there is a brief look at the sorts of institutional innovations that would be required to provide adequate finance to take full advantage of those opportunities.

Introduction: The mixed consequences of major bubble collapses

Major bubbles in the market economy are complex processes with mixed consequences. The NASDAQ boom, the collapse of which brought a two year recession and permanently wiped out half the illusory value of the inflated technology stocks, facilitated enough over-investment in telecommunications and fibre optic cables to interconnect the global space digitally and bring hundreds of millions of people into Internet use.1 The 2008 meltdown is having and will have a much deeper and more widespread negative impact on the global economy. The upside of that is made up of two very different consequences: One is the fact that from 2004 to 2007 there was a definite impulse to global growth. At the centre of it were the Asian economies, especially China and India, which through their lower costs for products and services increased the buying power of salaries in the already industrialised world and also gave a respite to the energy and materials exporting countries through a major increase in prices. This had as a counterpart, though, that the boost in consumption in the more advanced economies that facilitated this global growth was fed by the export surplus funds coming back from Asia. This inflated the housing bubbles that nabled growing consumer credit on the back of the asset price gains. The bursting of those bubbles has brought the whole network down and turned the positive feedback loop into a vicious downward spiral. Nevertheless, globalisation is a fact and the new emerging economies will change the shape of the world to come.

The other consequence of the bust, which could in some sense be defined as ‘positive’, is that by revealing all the crooked ways of the financial world during the boom, it has broken the myth of an ideal ‘free market’ and brought back the State into an active role in the economy. Such a come back is not limited to restraining the abuses of finance but extends to avouring the expansion of production and job creating activities over speculation and to spreading the benefits of growth more widely across society. This happened in the past after each of the major technology bubbles, with different intensity and in varying manners depending on the historical moment and on the specific technological revolution that underlay the boom. The most recent and strongest case of State intervention in these directions is, of course, the Welfare State and the Bretton Woods agreements and institutions, after the war and the long depressive years of the 1930s. The set of institutional innovations adopted then was very well adapted to the requirements of the mass production technologies of the time, which were able to bring consumer prices down to the level of workers’ wages, as long as the market was large enough to reap the full economies of scale.

The current meltdown will require, after the initial rescue of finance, an equivalent set of institutional innovations at several levels: global, supranational, national, regional, local and community. The governance structure of societies is likely to experience changes as profound as those that turned the rigid pyramidal and strictly hierarchical and compartmented organizations of giant corporations into relatively flat, highly flexible and dynamic networks spanning the globe. Rather than strictly separate single-function departments with interaction only at the top, these nimble giants now count on innumerable single-purpose (though often multi-function) units that are small, agile, creative and empowered to pursue the defined objectives in their own chosen manner and to respond immediately and autonomously to changes in context or in clients’ demands. A transformation of equivalent magnitude and direction is now in order for the State at all levels, though taking into account the difference in criteria, guiding principles and goals.

This essay begins by briefly summarizing the path followed by the operation of the market system in the process of installing and deploying successive technological revolutions and locating the current historical moment in that recurring sequence. A second section examines the sources of criteria to ‘foresee’ the directions of innovation in the next two or three decades and the final section discusses the policy challenges posed specifically by the need to foster the pursuing of those directions.

1- The Internet really only began in 1994 but by 2000 there were already more than 300 million people using it. The estimate now is one and a half billion. From http://www.internetworldstats.com/stats.htm downloaded April 13, 2009

"Technological Revolutions and Techno-economic paradigms"

(2010) In Cambridge Journal of Economics, Vol. 34, No.1, pp. 185-202

Spanish translation: Revoluciones tecnológicas y paradigmas tecno-económicos

Table of Contents

6.1. The changes in the cost structure

6.2. The perception of opportunity spaces

6.3. New organisational models

List of Tables and Figures

Figure 1. The trajectory of an individual technology

Abstract

This paper locates the notion of technological revolutions in the Neo-Schumpeterian effort to understand innovation and to identify the regularities, continuities and discontinuities in the process of innovation. It looks at the micro- and meso-foundations of the patterns observed in the evolution of technical change and the interrelations with the context that shape the rhythm and direction of innovation. On this basis, it defines technological revolutions, examines their structure and the role that they play in rejuvenating the whole economy through the application of the accompanying techno-economic paradigm. This over-arching meta-paradigm or shared best practice ‘common sense’ is in turn defined and analysed in its components and its impact, including the influence it exercises on institutional and social change.

Introduction

"The double bubble at the turn of the century: technological roots and structural implications"

2009. Cambridge Journal of Economics, Vol. 33, No. 4, pp. 779-805 ISBN 0-86187-949-X

2009. “Technological roots and structural implications of the double bubble at the turn of the century”, CERF Working Paper No. 31 Cambridge Endowment for Research in Finance, Judge Business School, University of Cambridge, U.K. April.

Abstract

This paper argues that the two boom and bust episodes of the turn of the Century -the Internet mania and crash of 1990s and the easy liquidity boom and bust of 2000s- are two distinct components of a single structural phenomenon. They are essentially the equivalent of 1929 developed in two stages, one centred on technological innovation, the other on financial innovation. Hence, the frequent references to that crash, to the 1930s and to Bretton Woods, are not simple journalistic metaphors for interpreting the “credit crunch” and its solution, but rather the intuitive recognition of a fundamental similarity between those events and the current ones. The paper holds that such major boom and bust episodes are endogenous to the way in which the market economy evolves and assimilates successive technological revolutions. It will discuss why it occurred in two bubbles on this occasion; it examines the differences and continuities between the two episodes and presents an interpretation of their nature and consequences.

Table of Contents

1. Major Technology Bubbles as Endogenous Phenomena

The concentration on the new technologies

Decoupling and switch to quick capital gains

The unwitting role of the MTB

2. Why the Double Bubble? The technological and historical factors

3. Two Different Bubbles: From technological to financial innovation

From opportunity pull to easy credit push

The structural transformation in the economy

4. The Underlying Continuity: The exacerbation of the casino from one boom to the next

The bias towards finance

The double bubble and the full consequences

5. Conclusion: The special nature of major technology bubbles and the policy challenge

References

List of Tables and Figures

● Table 1 Five great surges of growth and five major technology bubbles

●Figure 1 Three major technology bubbles as paroxystic culmination of a long process of experimentation with new technologies and infrastructures

● Figure 2 Major technology bubbles involve differential asset inflation biased to the “high tech” stocks – the information technology bubble in the 1990s

● Figure 3 The mass production bubble in the 1920s was also concentrated on the high tech stocks

● Figure 4 At the boom, the NASDAQ overtook the NYSE in volume of trading

● Figure 5 The abandonment of fundamentals: Not earnings but capital gains

● Figure 6 The abandonment of fundamentals is even more intense regarding the new technologies

● Figure 7 The decoupling of the stock market from the real economy: market capitalisation disregards the behaviour of profits

● Figure 8 The intensification of financial activity overtakes asset inflation during the bubble

● Figure 9 Much of the increased bubble activity revolves around the new tech stocks

● Figure 10 The more enduring impact of the bubble collapse on the new technology sectors than on the rest

● Figure 11 The MTB also fosters the flourishing of new companies and types of funds in the financial sector

● Figure 12 The late 1920s as a single major technology bubble

● Figure 13 The 1990s and the 2000s: Different focus on technology or financial shares

● Figure 14 The 1990s and the 2000s: Differential asset inflation

● Figure 15 The 1990s and the 2000s: Change in the weight of new technology shares

● Figure 16 The 1990s and the 2000s: Very different real interest rates

● Figure 17 Two rhythms of monetary expansion according to Milton Friedman

● Figure 18 The 1990s and the 2000s: Continuity and acceleration in the instruments of casino-type speculation

● Figure 19 The intensification of globalisation after the MTB collapse and into the ELB

● Figure 20 The intensification of the MTB bias towards financial profits during the ELB

● Figure 21. A The decoupling from the real economy intensified from the 1990s to the 2000s

● Figure 21. B The contrast with the deployment period of the previous surge: 1947-1974

Introduction

The economic literature seems to pay less attention to financial bubbles than would be warranted by their profound effect on economic growth both during the boom and after the bust. There tends to be an implicit agreement that they are a derailment of the market mechanism due to external causes. In fact, the Austrian and Chicago schools, but also most neoclassical economists, tend to lay the blame on government, be it monetary policy or distorting regulation (Hayek 1933; von Mises 1949). The rational expectations school is more inclined to see such events as the intelligent work of the invisible hand, as seen in the literature on rational bubbles (Blanchard and Watson 1982; Diba and Grossman 1988).By contrast, J.K. Galbraith (1990) saw them as a recurring loop of delusion built-up by the market mechanism, but as fundamentally irrational and due to mass euphoria, herd behaviour and greed. It was Minsky (1982) -following Keynes (1936), and in turn followed by Kindleberger (1978)- who saw financial crises as a natural consequence of the way debt markets work and advanced the financial instability hypothesis.

This paper proposes to distinguish major technology bubbles (MTBs) as a special class of bubbles that constitute a recurring endogenous phenomenon, caused by the way the market economy absorbs successive technological revolutions (Perez 2002). They are different both in nature and consequences from the bubbles induced by excess liquidity from whatever source and from the Ponzi finance moments identified by Minsky. They are the result of opportunity pull rather than of easy credit push. But they are indeed bubbles. They are moments of Galbraithian irrationality, but, at least in terms of prefiguring the future value of some of the stocks involved, they also contain an element of rationality (Pastor and Veronesi 2004 and 2005).

History has given us the ideal laboratory: a major technology bubble -the 1997-2000 Internet Mania- followed by the easy liquidity bubble of 2004-07. The fact that they took place in rapid succession provides us with clearly comparable and compatible data. Yet it also suggests that they are strongly connected and interrelated.

This paper will argue that the two bubbles of the turn of the century are two stages of the same phenomenon. The first section below discusses the endogenous nature and consequences of major technology bubbles. The second analyses the reasons for the easy liquidity bubble to have followed in the wake of the NASDAQ collapse. In the third and fourth parts the two bubbles will be contrasted and compared, distinguishing their differences and similarities. Finally, there will be a brief summary of the argument and its implications in terms of policy challenges.

WP: "Great surges of development and alternative forms of globalization"

2007. TOC/TUT WP No. 15 Working Papers in Technology Governance and Economic Dynamics, The Other Canon Foundation, Norway and Tallinn University of Technology, Estonia.

2009 Published in Spanish: “La Otra Globalización Los Retos del Colapso Financiero”, Problemas del Desarrollo: Revista Latinoamericana de Economía Vol. 40, No. 157, pp. 11-37 (México) April

Table of Contents

2. The ruthless role of the major technology bubbles

3. The legacy of the bubble: three tensions at the Turning Point

4. The need for institutional recomposition to favor production over finance

5. Why globalization?

6. Some thoughts on the possibility of a positive-sum globalization

7. The Institutional Challenge

List of Tables and Figures

● Table 1 The five great surges of development: Technological Revolutions and Techno-economic paradigms

● Figure 1 The double nature of technological revolutions

● Table 2 A different techno-economic paradigm for each great surge of development

● Figure 2 The life cycle of a technological revolution

● Figure 3 The social assimilation of technological revolutions breaks each great surge of development in half

● Figure 4 Parallel surges with major bubbles, Golden Ages and approximate dates of Turning Points

● Figure 5 Income polarization as one of the negative legacies of the Installation Period

Introduction

The present understanding of globalization is inextricably tied to the free market ideology for both proponents and opponents. This paper will argue that globalization has many potential forms of which the neo-liberal recipe, applied up to now, is only one.

The need to recognize the whole planet as the economic space is an inherent feature of the present technological revolution and its techno-economic paradigm. However, just as national State intervention in the economy took several different forms in the previous mass production (or “Fordist”) paradigm, so globalization can be socially and politically shaped in order to favor truly global development and support the full deployment of the current flexible production (or Information technology) paradigm.

Simply put: globalization need not be neo-liberal. A pro-development version of globalization has not yet been designed or defended as such (1). It will be argued that, without it, not only would it be very difficult to relaunch development in the South but also to overcome the present instabilities, imbalances and recessionary trends in the economies of the North.

These propositions stem from an historically-based model of the way in which successive technological revolutions are assimilated in the economic and social system, generating great surges of development that follow a recurring sequence and involve major readjustments in both the economic and the socio-institutional spheres (2).

In terms of this model, the present period, after the collapse of the major technology bubble, would be at the mid-point of the current great surge, right when the structural tensions that underlie the ensuing instability and recessionary trends require a fundamental institutional recomposition. Among other tasks, income needs to be re-channeled towards new layers of consumers in order to help overcome the premature market saturation that results from the polarization of income in the top band of the spectrum in each country and in the world. This paper will argue that the present is, for that reason, the most appropriate time to put forth bold proposals for a profound redesign of global regulation and institutions.

The argument is developed beginning with a general summary of the model, in section 1. Then, Section 2 focuses on the recurrence of great financial bubbles, a decade or two after the irruption of each technological revolution, and examines their role in facilitating paradigm shifts and in concentrating investment in the installation of the new infrastructures. Section 3 analyzes the post-bubble recessions and the structural distortions inherited from the “casino” economy, while Section 4 discusses the need to overcome those tensions by means of appropriate regulation and institutional changes. Section 5 analyzes the globalizing nature of the Information Technology paradigm followed in section 6 by a discussion of the features of that paradigm that could lead to a positive-sum game between North and South. Finally, section 7 looks at the institutional challenges involved in such a post-neo-liberal form of globalization taking into account some of the present world trends and their possible outcomes.

1 Though it could be held that the European Union has some important features of such a version Up

2 This paper is largely based on Perez (2002) [Spanish edition 2004]

WP: "Respecialisation and the deployment of the ICT paradigm: An essay on the present challenges of globalisation"

2007. In Compano et al., The Future of the Information Society in Europe: Contributions to the Debate, Technical Report EUR22353EN, IPTS, Joint Research Centre, Directorate General, European Commission).

Table of Contents

1. ICT shaping and being shaped by the global context

2. The recurring diffusion pattern of revolutionary technologies

Double nature of technological revolutions

A similar sequence of propagation

3. Installation and deployment: different conditions and behaviours

The basic differences

Shift in innovation and target markets

From creating to spreading the new lifestyles

Complementary role of the induced branches

Gestation of the next technological revolution

Shift in investment criteria

The turning point as the space for the role-shift

Positive legacy of the bubble: conditions for full expansion

Negative legacy of the bubble: three tensions making obstacle to growth

Tension between the paper and the real economy

Tension between the size and profile of effective demand and those of potential supply

The political tensions between the poorer poor and the richer rich

Free markets as intensifiers of the problems

4. Globalisation, market segmentation and the nature of the ICT paradigm

A look at the two globalisations

The ICT paradigm and globalisation

ICT and the hyper-segmentation of markets: Outsourcing and off-shoring

5. The challenge of respecialisation in a globalised world

The policy dilemmas and the way forward

Global redistribution of market segments in all industries

Challenges and opportunities from “global push”

Opportunities created by “local pull”

The role of ICT as the platform for the whole process

6. Policy action towards a sustainable and cohesive globalisation

Three tensions: Three policy areas

Regulation

Respecialisation

National and global social net policies

Previous success as the main obstacle

References

List of Tables

- Table 1 The five great surges of development: Technological Revolutions and Techno-economic paradigms

- Table 2 The different features of the Installation and Deployment periods

- Table 3 The respecialisation of the advanced countries: Local specificity as one of the forces guiding investment for the domestic market

List of Figures

- Figure 1 The social assimilation of technological revolutions breaks each great surge of development in half

- Figure 2 Variation in the share of the nation’s income earned by the top 0.1 percent of U.S. taxpayers 1920-2002

- Figure 3 Market segmentation and its differing conditions from raw materials to all manufacturing and services

- Figure 4 Some examples of products in different market segments

- Figure 5 Possible trends in the global distribution of the hyper-segmented markets of each industry

"Finance and technical change: A long-term view"

2004. In H. Hanusch and A. Pyka, eds. The Elgar Companion to Neo-Schumpeterian Economics, Edward Elgar, Cheltenham, pp. 775-99

WP “Finance and technical change: A Neo-Schumpeterian perspective” CFAP-CERF WP No. 14 , Cambridge Endowment for Research in Finance, Judge Business School, University of Cambridge, U.K.

2011. African Journal of Science, Technology, Innovation and Development Vol. 3, No. 1, pp. 10-35.

Abstract

The paper presents an alternative model of the emergence and propagation of technological revolutions. It proposes an explanation of the clustering and the spacing of technical change in successive revolutions. It provides arguments for the recurrence of clusters of bold financiers together with clusters of production entrepreneurs and an interpretation of major financial bubbles as massive episodes of credit creation, associated with the process of assimilation of each technological revolution. It concludes by demonstrating that financial capital has a fundamental role in the articulation and propagation of technological revolutions.

Introduction

Ever since Kuznets published his review (1) of Business Cycles questioning the sudden clustering of entrepreneurial talent that was supposed to accompany each technological revolution (2), Schumpeter’s followers have felt uneasy about this unexplained feature of his model. Yet apparently no one has stopped to question Schumpeter’s treatment of the clustering of ‘wildcat or reckless banking’, dismissing it as a random and unnecessary phenomenon to be excluded from his model, together with speculative manias (3)

Keeping Schumpeter’s basic assumptions about innovations based on credit creation as the force behind capitalist dynamics, this chapter will present an alternative model of the process of propagation of technological revolutions. On that basis it will propose:

- a) An explanation of the clustering and the spacing of technical change in successive revolutions;

- b) An argument for the recurrence of clusters of bold financiers together with clusters of production entrepreneurs and

- c) An interpretation of major financial bubbles as massive episodes of credit creation, associated with the process of assimilation of each technological revolution

The model is a stylized narrative, based on a historically recurring sequence of phases in the diffusion of each technological revolution, from its visible irruption after a long period of gestation, through its assimilation by the economic and social system to the exhaustion of its innovation potential at maturity. But it is not merely descriptive. It is constructed through the identification of possible causal chains between agents and spheres in capitalist society. What the model attempts to do is identify the repetition of certain underlying patterns and to propose plausible explanations.

The reader is asked to keep this purpose in mind, together with the additional caveat that neither the evidence nor much subtlety can be included in the limited space of a chapter (4). Suffice it to say that this model is not a straitjacket to be forced upon history. Rather than ignore the immense richness of historical evolution, it emphasizes the uniqueness of each occurrence and recognizes the many irregularities and overlaps that cannot be captured by abstraction. Its only claim is to serve as a useful heuristic tool for historical exploration and as a framework for theoretical analysis.

- (1) Kuznets (1940), pp. 261–2

- (2) Schumpeter (1939:1982) p. 223

- (3) Schumpeter (1939:1982), pp. 792, 877

- (4) For a more complete presentation of the model, see Perez (2002)

Table of Contents

B. The double character of routines as obstacles and guides for innovation

C. Techno-economic paradigms as the meta-routines for a long period

D. Production and financial capital: different and complementary agents

E. Technological revolutions and great surges of development

F. The sequence of diffusion of each technological revolution

G. Why technical change occurs by revolutions

Embedded paradigms as inclusion-exclusion mechanisms

Exhaustion of opportunity trajectories leading idle money to search elsewhere

The role of finance in fostering the new paradigm

An endogenous process with a specific rhythm

E. Financial bubbles as massive processes of credit creation

The power of finance backing the paradigm shift

The making of the bubble

When the job is done, it’s time for the changeover in leadership

F. Summary and Conclusion

Finance and paradigm shifts

Clusters of bold financiers and the invisible hand for credit creation

The research ahead

"Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages"

"Structural Crises of Adjustment, Business Cycles and Investment Behaviour"

1988. With C. Freeman “Structural Crises of Adjustment, Business Cycles and Investment Behaviour”, in G.Dosi et al. eds. Technical Change and Economic Theory, London: Francis Pinter, pp. 38-66.

1998. Reprinted in H. Hanusch ed. The Economic Legacy of Joseph Schumpeter, Elgar, London.

Table of Contents

1. Introduction

2. Areas of agreement in business cycle theory

3. Keynes

According to Schackle

Siegenthaler comments

4. A taxonomy of innovations

(i) Incremental innovations

(ii) Radical innovations

(iii) Changes of ‘technology system’

(iv) Changes in ‘techno-economic paradigm’ (‘technological revolutions’)

5. ‘Key factor’ inputs and change of techno-economic paradigm

(i) Clearly perceived low and rapidly falling relative cost

(ii) Apparently almost unlimited availability of supply over long periods

(iii) Clear potential for the use or incorporation of the new key factors in many products and processes throughout the economic system Table 3.1 6. Diffusion of new techno-economic paradigms and institutional change

7. The information technology paradigm

8. The structural crisis of the 1980s

9. References

Introduction

This chapter discusses the revival of interest in long-term fluctuations in the growth of the world economy and particularly in the Schumpeterian theory of business cycles. After reviewing the common ground in relation to investment behaviour and business cycles, it goes on to discuss the failure of Keynesian economics to come to terms with the influence of technical change. The central theme of the chapter is that certain types of technical change – defined as changes in ‘techno-economic paradigm’ – have such widespread consequences for all sectors of the economy that their diffusion is accompanied by a major structural crisis of adjustment, in which social and institutional changes are necessary to bring about a better ‘match’ between the new technology and the system of social management of the economy – or ‘regime of regualtion’. Once, however, such a good match is achieved a relatively stable pattern of long-term investment behaviour can emerge for two or three decade. This point is illustrated with respect to the rise of information technology. It is argued that this pervasive technology is likely to heighten still further the instability of the system before a new, more stable pattern of growth is attained.

The resurgence of interest in Schumpeter’s ideas (e.g. Elliott, 1985) is associated with the slow-down in the growth of the world economy in the last decade. Whereas during the prolonged post-war boom of the 1950s and the 1960s there was some tendency to assume that the general adoption of Keynesian policies would prevent the recurrence of the any depression comparable to that of the 1930s and would smooth out small fluctuations, this confidence was somewhat undermined by the deeper recessions of the 1970s and 1980s and the return of much higher levels of unemployment. Not surprisingly, this has led to renewed interest in long-cycle or long-wave theories, which make analogies between the 1930s and 1980s. This chapter concentrates on the explanation of these deeper structural crises of adjustment, without making any assumptions about fixed periodicity or statistical regularity.

We start by looking at the common ground in the analysis of business cycles. We shall quote extensively from Samuelson for several reasons. First of all, he is probably the most authoritative neo-Keynesian economist, and one who commands respect through the profession. Secondly, business cycles have always been one of his central professional interests. Thirdly, as author of the most widely read economics textbook in the Western World, he provides in the successive edition of this book a convenient synthesis of the changing state of the art (Samuelson and Nordhaus in the most recent and thorough revision, i.e. the 12th edition)

"The new technologies: An integrated view"

1986. From the original Spanish, ”Las Nuevas Tecnologías, una Visión de Conjunto” in Carlos Ominami ed., La Tercera Revolución Industrial: Impactos Internacionales del Actual Viraje Tecnológico, RIAL, Grupo Editor Latinoamericano, Buenos Aires, pp. 43-90 ISBN : 950-9432-65-2

Also published en Estudios Internacionales, Año XIX, Oct.-Dic. 1986 No.76, pp. 420-459, Santiago de Chile

English translation by the author

WP: “The new technologies: An integrated view”, July, 1986, TOC/TUT WP No. 19, WPs in Technology Governance and Economic Dynamics The Other Canon Foundation, Norway and Tallinn University of Technology, Tallinn

Table of Contents

Introduction

I. How to put some order into the variety of technical change

II. Techno-economic paradigm as “common sense” models in the productive sphere

III.Structural change and socio-institutional transformation

IV. An exploration of the features of the new paradigm

NEW PARAMETERS FOR INNOVATION TRAJECTORIES

A. New guiding concepts for incremental product innovations

B. New trajectories for radical product innovations

NEW CONCEPTS FOR THE BEST PRACTICE IN PRODUCTION

A. Energy and materials: saving, recycling and diversification

B. Flexibility in plant: diversity in products

C. Technological dynamism: Design as an integral part of production

D. Supply adapted to the shape of demand

A NEW MODEL FOR MANAGERIAL EFFICIENCY

A. Systemation: The firm as an integrated network

B. “On line” adjustment of production to market demand

C. Centralization and decentralization

V. New technologies and new paradigm

A. Complementarity within the productive system as a whole

B. Complementarity at the level of the ideal model of production

C. Technological convergence: Bioelectronics

D. Factors which can influence the direction of biotechnology

VI. Technological transition and development prospects

RETHINKING THE ROUTE TO DEVELOPMENT

A. The systemic view

B. A new approach to the domestic market

C. Leaping to the new technologies

D. New strategies, new instruments

OBSTACLES AND OPPORTUNITIES

Bibliography

Introduction

Interest in technical change has grown explosively in the last decade. Industrial policy, both in developed and developing countries, increasingly includes an explicit technology component. For this reason technological forecasts are becoming a prerequisite for planning. Two questions then arise: How reliable are technological forecasts? How useful are they as a guide for development strategies?

Past experience is highly uneven. In general there would seem to be a gap between the capacity for extrapolating trends in technology itself and that for predicting rates of diffusion in the productive sphere. This gap is wider the newer the technology and becomes narrower as the diffusion process develops, when related social and economic factors have become manifest revealing the selection criteria.

In fact, the world of the technically feasible is far greater than that of the economically profitable and that of the socially acceptable. And the two latter sets do not coincide either. This could mean that pure technological forecasting would be of limited use as a guide for development policy. A fuller exploration is required in order to identify the economic and social forces that drive and influence the course of technical change, as well as the forms in which technology influences the economy and society. This paper is an attempt in that direction.

The first part presents a set of categories with which to approach the analysis of technical change. In the second part, a hypothesis is presented about the constitution and diffusion of successive “techno-economic paradigms”. The crystallization of each paradigm would produce a radical shift in the course of evolution of the technologies of a given period, resulting in profound structural change in the economic sphere. The third part examines the way in which such a process of structural change would demand equally profound transformations in the socio-institutional sphere.

Following this general model of analysis, it is suggested that we are at present in a period of global technological transition, which offers new opportunities for outlining development strategies. Profiting from these new possibilities would require understanding the defining features of the new techno-economic paradigm, which, in the present case would be the system of technologies based upon microelectronics. Part four, then, examines some of these features, pointing to the specific ways in which they influence the direction of technological evolution in products, production processes and in the forms of organization of the firm. Part five explores the possible impact of the new prevailing technological model upon other new technologies, specifically: new energy sources, new materials and biotechnology. The final section is a discussion of some of the implications of the technological transition for development strategies.

"Structural Change and Assimilation of New Technologies in The Economic and Social Systems"

Also appeared as “Structural Change in Industry and Kondratiev Cycles”, in C. Freeman, ed. Design, Innovation and Long Cycles in Economic Development, Department of Design Research, Royal College of Art, London, 1984

Reprinted in C. Freeman, ed. The Long Wave in the World Economy, International Library of Critical Writings in Economics, Edward Elgar, Aldershot, 1996.

In Italian translation in “Cambiamento Strutturale e Assimilazione di Nuove Tecnologie nei Sistemi Economici e Sociali”

in P. Bisogno ed., Paradigmi Tecnologici: Saggi Sull Economia del Progresso Tecnico, Prometheus No. 2, Milan, pp. 155-186.

Abstract

Through generating a set of hypotheses about the inter-relationship between diffusion of new technologies and economic development, the author seeks to identify the causal mechanisms of the depressions of the trough of the Kondratiev long waves. A model of the capitalist economy and an analysis of its structural patterns and processes are proposed, and from an examination of the techno-economic and socio-institutional characteristics of the fourth Kondratiev, some institutional requirements for the next upswing are elaborated.

Table of Contents

1. A set of hypotheses

2. Model of the capitalist system

3. Model elements

Technological styles

Investment patterns

a. The carrier branches

b. The motive branches

c. The induced branches

4. Upswing characteristics

5. Downswing characteristics

6. Patterns and processes of transformation

7. Taylorism: Seeds of the Fourth Kondratiev

Occupational structure

Income distribution

Product demand

Transformation process

8. Mass production technological style

9. Socio-institutional structures

10. Institutional requirements for the next upswing

Development and Sustainable Growth

“The green transformation as a new direction for techno-economic development”

Lema, Rasmus and Perez, Carlota (2024) The green transformation as a new direction for techno-economic development. UNU-MERIT Working Paper #2024–001. United Nations University, Maastricht Economic and social Research institute on Innovation and Technology, the Netherlands.

Table of Contents

1 Introduction

2 Green as a direction of techno-economic development

2.1 The specificities of the green transformation

2.2 Creating direction in the age of ICTs

2.3 The role of ICTs in the green economy

3 Implications for latecomer development

3.1 Green windows of opportunity

3.2 Using ICTs to promote sustainable development

3.3 The interface between green transformations, natural resources and ICTs

4 Conclusions and policy recommendations

4.1 Development strategy in transformative times

4.2 Shaping transformation for development

4.3 The need for an institutional revolution

5 References

Abstract

In this chapter we argue that the ongoing debate about the green transformation and latecomer development must consider two key conditions. First, it must recognize that the green transformation is primarily a direction-driven phenomenon, shaped by aspirational, political, and institutional changes, rather than a technology-driven phenomenon per se. Second, it must acknowledge the potential of information and communication technology (ICT) to both accelerate and deepen the green transition and to foster latecomer development. Governments may unlock crucial synergies and opportunities by pursuing green development with the power of ICT.

Table 1: Green direction compared to Post war suburbanization

“Redirecting growth: Inclusive, sustainable and Innovation-led”

2022 Mazzucato, M and Perez, C. “Redirecting growth: Inclusive, sustainable and Innovation-led”. In Modern Guide to Uneven Economic Development edited by Erik S. Reinert and Ingrid Harvold Kvangraven. Cheltenham: Elgar.

Table of Contents

1. Introduction

2. History matters

2.1 Great surges, technological paradigms and bubbles

3. Innovation and finance

3.1 Uncertain cumulative innovation requires patient, long<term, committed capital

3.2 Supply of finance vs. demand for finance

4. The Green direction

4.1 Innovation potential, direction and deployment

4.2 What is green growth?

4.3 A political choice for growth, convergence and synergies

5. State as lead market-creating ‘investors’, not market-fixing ‘spenders’

6. Inclusive growth

6.1 Unemployment and the need for respecialisation

6.2 Sharing both risks and rewards

6.3 Picking a direction for the willing

7. Conclusion: Green growth requires innovative, smart, green government

7.1. New context, new direction, new policy criteria

References

Abstract

"A smart green direction for innovation: the answer to unemployment and inequality?"

2022 Perez, C and Murray Leach, T. in Benner, Marklund and Schwaag Serger editors Smart Policies for Societies in Transition, Cheltenham: Elgar (open access)

Table of Contents

- Introduction

- Technological revolutions and innovation

- Recurring inequality and unemployment

- The social shaping of technologies: providing a direction for deployment

- The proactive State promoting growth and employment

- The social State promoting general wellbeing and reversing inequality

- A global route to full employment and well-being

Introduction

With the increasing impact of robotics on manufacturing, the rise of services such as Uber and internet shopping, and the emergence of artificial intelligence, one cannot blame the many voices that fear increasing unemployment and job insecurity into the future. Is innovation at fault? No. It is the lack of appropriate policies.

Our research shows that technological progress follows a pendular pattern. Ever since the first ‘Industrial Revolution’, each major technological shift has created entirely new avenues for innovation, capable of offering a leap in productivity – which, by definition, means less labour per unit of output. Such a leap also means that the same output in money terms can potentially fulfil more needs for more people, with less work; with more (if different) products and services at lower prices. This could therefore be seen as a definition of progress. The current technological age has even resulted in the provision of free welfare goods through Google, Wikipedia, YouTube, Skype, WhatsApp, GPS, Linux and so on. Yet at the same time, stagnant salaries for the majorities, rising inequality, the likelihood of increasing unemployment, and the predictions of secular stagnation (due to insufficient or inconsequential innovation) are seriously calling into question the role of innovation in social advance – or simply in growth.

In this chapter we shall argue that, after those initial contradictory effects, each technological revolution can transform the whole economy and bring greater growth and wellbeing to increasing portions of the population –in our current case, on a global scale. But that has never been – and cannot today be – the result of technology by itself or of markets alone. That outcome has each time required the mediation of an active State tilting the playing field to entice convergent innovation and investment. It is a socio-political choice for guiding the revolutionary industries – using policies, taxation, subsidies and regulation – in a recognisable direction for profitability, while being beneficial to society. Such a direction has always involved a shift in lifestyles, which induce multiple lower productivity activities that have counteracted technological unemployment.

In this article we begin by laying out the regular pattern in the process of assimilation of the successive technological upheavals, since the first ‘Industrial Revolution’ in the 18th century. We show that, even though the early period of each technological revolution is turbulent and financialised, breeding inequality whilst also creating bubbles, what has followed after the inevitable crashes and recessions has been recognised as the ‘golden ages’ of each of those major transformations. We then explain how, in order to bring about such periods of prosperity, the state has – consciously or unconsciously – through its coherent actions, provided a synergistic direction that shaped the context and expanded the market. Then we look at the recurring patterns of inequality and unemployment that have accompanied the early decades of diffusion of each of the great surges of development driven by these revolutions, at the way that government has acted to reverse or mitigate these issues, and at the specific directions that have unleashed the ‘golden ages’, and spread prosperity across society. On that basis, we will propose ‘smart green growth’ and full global development as the most promising directions for achieving a sustainable global golden age with the ICT revolution and argue that this change has already begun. We end by arguing the need for consciously placing innovation policy at the core of growth policy.

‘Transitioning to Smart Green Growth: Lessons from History’

Perez, C. (2019) In Fouquet, R. (ed.) Handbook on Green Growth, Cheltenham: Elgar, pp 447-463

Table of Contents

● How did the Great Depression lead to the Post-War Golden Age?

● Why can ‘smart green growth’ be a successful direction now?

● The role of relative prices in shaping and accelerating the transition

● The fear of technological unemployment may be unwarranted

● The lessons of the transition from the 1930s to the post-war boom

● Inequality and ‘differential recession’ as obstacles to visibility and action

● Why would full global development be in the interest of the advanced world?

● Creating the conditions for the best of possible futures

● References

Section 3: The role of relative prices in shaping and accelerating the transition

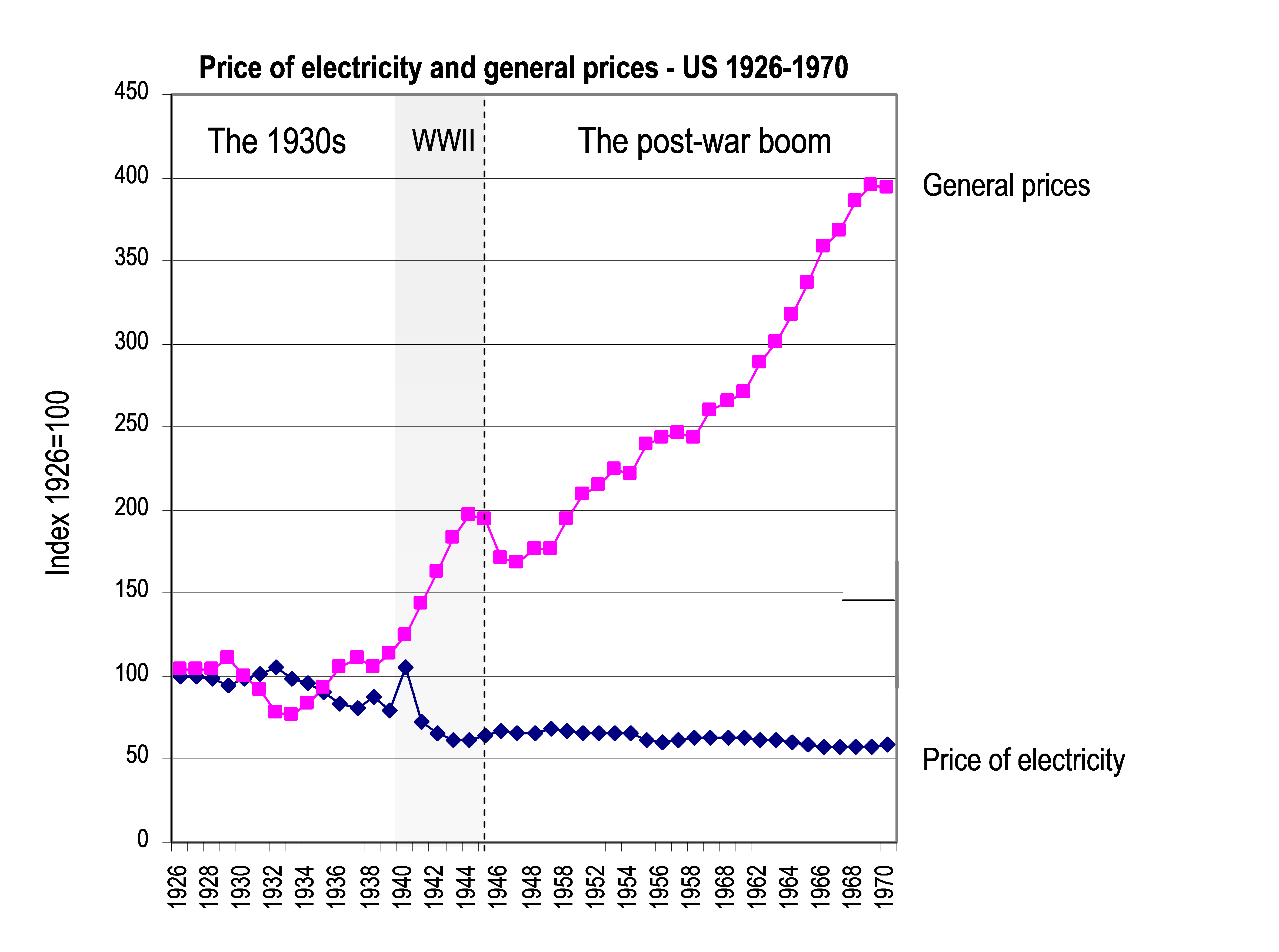

The provision of cheap energy was a fundamental driver of the consumption pattern during the post-war boom. Both the production and the use of automobiles and electrical appliances were energy- and materials-intensive. During that time, the price of fuel and electricity in the US actually decreased, while all other prices increased significantly (see Figure 2).

By contrast, the cost of labour was going up through the pressure of the officially recognised labour unions and the reduction of the working day, week and year. Those changes increased consumption demand and spurred increases in scale and productivity in manufacturing, which were basically obtained through replacing expensive labour with machinery moved by cheap energy.

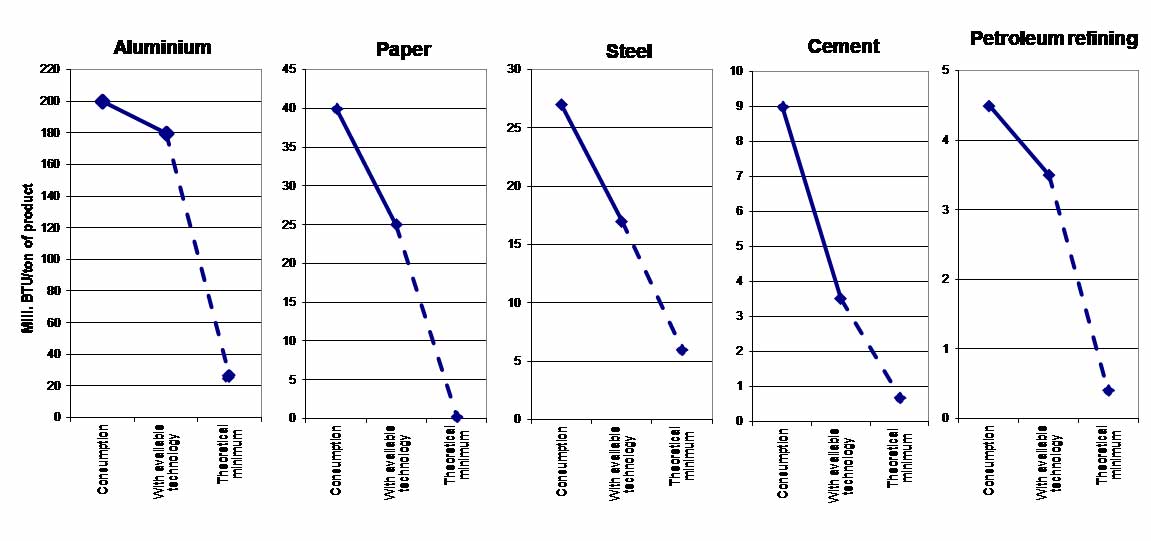

The rapid reduction of industrial energy consumption achieved after the hike in oil prices of the 1970s and 80s was not due to great innovation. Aluminium, paper, steel, cement and petroleum refining represented 60% of industrial energy use in the United States. Each could have saved between 10 and 60% using technologies that were readily available, but were not applied before because –as they frankly declared– energy was ‘too cheap to worry about’ (see Figure 3).

The six Industries with maximum energy consumption in the United States in 1974, potential reduction with available technology in the 1970s and theoretical minimum

As the figure suggests, the potential for energy reduction is still significant (Grubler and Riahi 2010) and industry can move in that direction if the price of energy is made to reach a level where it is profitable to do the necessary research and the innovative investment. Markets do work, but the direction they take depends on the context, and that includes relative prices and relative taxes.

As to the consequences of expensive energy for low-income consumers, it is obviously a challenge for policy makers. Solutions should be found in some form of direct or indirect compensation that will, nevertheless still encourage personal energy-saving.

Conclusion: Creating the conditions for the best of possible futures

The context created by the turning point is one where the combination of threats and opportunities are at their maximum level. The socio-political turmoil and the decoupling of finance from production seem to leave leaders impotent to turn the tide. And yet, there is never a greater opportunity to unleash the best times that the system can provide. It is a question of tilting the playing field so that the interests of business coincide with those of the majority of society. Historical experiences can teach us how to do it; understanding the nature of the ICT revolution can give us the most appropriate directions in which to stimulate the underlying potential for innovation and investment.

In this chapter, we have argued that the most appropriate directions in which to guide the ICT potential are smart green growth, leading to a constant increase in the proportion of intangibles in GDP and in lifestyles, and full global development. Global reach is in the very nature of ICT, but without sustainability shaping it, the result will not be development. Both directions would be aimed at moving finance out of the current casino behaviour and reconnecting it with real production investment. It has happened at previous turning points and it can happen again. A win–win game is there to be unleashed between business and society in every country and between the advanced, emerging and developing worlds.

Unleashing the power of ICT to bring a sustainable global boom could do for the world population what the post-war golden age did for that of the Western democracies. To turn this possibility into probability will require a difficult consensus-building process, moved by persuasion – or by a serious decline in the world economy. It is to be hoped that persuasion will succeed in time.

“Smart & green. A new “European way of life” as the path for growth, jobs and well-being”

Perez, Carlota and Murray Leach, Tamsin (2018): Smart & green. A new “European way of life” as the path for growth, jobs and well-being. In: Council for Research and Technology Development (ed.): Re-thinking Europe. Positions on Shaping an Idea. Vienna: Holzhausen, pp. 208-223.

SSTR Working Paper Series 2018-1

From the publishers in English: RE:THINKING Europe and German: RE:THINKING EUROPE – Positionen zur Gestaltung einer Idee

Table of Contents

1. Introductions

2. Technological revolution and social change

3. New products, new lifestyles, new jobs

4. The last lifestyle shift: the American Way of Life

5. The emergent lifestyle shift today

6. The interplay of markets and policy in lifestyle changes

7. A European Way of Life

8. Conclusion

References

Introduction

In the history of technological revolutions, there is a moment in each revolutionary surge of development when the wild period of Schumpeterian creative destruction subsides, and the future promised by the new technologies looks uncertain. We are at this juncture today – when something must occur to foster investment, employment and innovation. The saviour in the past has been demand. And the source of that demand? A change in lifestyle: an aspiration to a new ‘good life’, underpinned by the new technology and fostered by government policy.

In this chapter we look at why this is the case, and examine the lifestyle shifts that have occurred in previous technological revolutions. We examine the legacy of the mass consumption American Way of Life, which is still with us today, and argue that a new smart, green, way of living is slowly replacing it. And we conclude with the claim that Europe is in a unique position to adopt this way of life as its own, and play a formative role in creating a global golden age in the years to come.

“Searching For An Alternative Economic Model”

2018 – Rodrik, Perez et al. In IPPR Progressive Review. Perez: “Turning environmental problems into opportunities for growth and jobs”

Table of Contents

⇒ Take control, for what?

Dani Rodrik

⇒ Turning environmental problems into opportunities for growth and jobs

Carlota Perez

⇒ Fragmented, but not diminished? Finance, the city of London, and the false hopes of brexit

Anastasia Nesvetailova

⇒ Giving substance to economic justice

Donald J. Harris

⇒ Owning the future

Laurie Macfarlane

⇒ Work and social justice

Diane Perrons

Highlights

“The key to economic growth is the nature of demand – and the combination of the information revolution and the pressing need for sustainability is the key to shaping it”

“Today’s pro-growth lobbyists are correct about one thing: there are many people still to be lifted out of poverty in the world”

“The planet cannot sustain the mass production model of consumption, but the transition needs to be presented as a desirable future without sacrifices”

Carlota Perez

“Innovation as Growth Policy: The Challenge for Europe”

SPRU Working Paper series, No. 13, 2014

Abstract

The advanced world is facing a crucial moment of transition. We argue that a successful outcome requires bringing innovation to the centre of government thinking and action and that, in order to do this, we must apply our knowledge of how innovation occurs and how to repair what has gone wrong. We look first at the role that innovation has always played as the driver of economic growth, and at its relationship with finance. Arguing that the challenge today is not to ‘fix’ finance while leaving the economy sick, but rather to change the way that the real economy works, we then identify the solution: a policy direction that is smart, inclusive and takes advantage of ‘green’ as the next big technological and market opportunity. We then explain why the role of the State is key to ensuring that such opportunities are taken, and the importance of direct public investment for promoting the creation of public goods and courageous risk-taking in research and innovation in both the public and private sectors. Paying particular attention to Europe, we then examine the potential of such innovation-oriented policies to promote inclusive growth. We consider concrete steps that could be taken, both at the national and EU levels, to create the ‘smart governance’ necessary to implement such a direction. The chapter closes with suggestions for policies that aim to construct collective competitiveness across the European Union.

Table of Contents

9.1. Introduction

9.2. History Matters

9.2.1 Great Surges, Technological Paradigms and Bubbles: Understanding the Context

9.3. Innovation and Finance

9.3.1 Uncertain Cumulative Innovation Requires Patient, Long-Term, Committed Capital

9.3.2 Supply of Finance vs. Demand for Finance

9.4. The Green Direction

9.4.1 Innovation Potential, Direction and Deployment

9.4.2 What is Green Growth?

9.4.3 A Political Choice for Growth, Convergence and Synergies

9.5. State as Market-Creating ‘Investors’, Not Market-Fixing ‘Spenders’

9.5.1 Investment for Innovation and Competitiveness in the Eurozone

9.6. Inclusive Growth

9.6.1 Unemployment and the Need for Respecialization

9.7. Smart Innovation Requires Smart Government

9.8. Conclusion: Towards a New European Competitiveness

Introduction

The advanced world is facing a crucial moment of transition. The 2008 bubble collapse left behind it the polarisation of incomes, high unemployment, low growth and a fearful financial sector that is steering away from funding the real economy and stays in a casino world, harming the prospects of revival. Indeed, the current emphasis on ‘fixing finance’, while leaving the real economy sick, risks setting the stage for the next bubble.

In this chapter, we argue that the theories underlying current policies are misguided and that the aim of returning to ‘business as usual’ is therefore mired in a fundamental misunderstanding. Current problems are structural and date back to decades before the crisis began. In particular, we take issue with the prevailing beliefs about private and public investment and about the role of the State in such investment. We also provide a different narrative of the State, in which what is needed is not just counter7cyclical spending, but an investment7driven, ‘mission7oriented’ (Foray et al., 2012) and courageous State that can not only guide Europe out of the crisis but also steer and direct growth when it returns (Mazzucato, 2013a). As increasing numbers of policy makers are recognising, dogged subscription to orthodoxy is a dead end: markets alone cannot return us to prosperity. Our work has shown that investment is driven by innovation; specifically by the perception of where new technological opportunities lie (Pavitt, 1984; Perez, 2002). Private investment only kicks in when those opportunities are clear; public investment must be directed towards creating those opportunities across all policy spaces and affecting the entire economy. Furthermore, the State’s role as an investor involves taking risks: win some, lose some. Such risks must be rewarded so that taxpayers not only socialise the risks, but also share in the rewards (Lazonick and Mazzucato, 2013).

We hold that success in the current transition requires bringing innovation to the centre of government thinking and action. Innovation policy must become growth policy and vice versa. In doing so, innovation7growth policy will affect all other policies: financial market reform, labour market policy and especially taxation. A clear understanding of the innovation potential inherent in the current historical moment will inform the direction that such policies take. Naturally, different pathways can be chosen while moving in this direction, but recognising the role of policy in choosing it enables a better understanding of the ‘boundaries’ within which civil society and other forces can operate (Stirling, 2009).

This chapter focuses on applying our knowledge of the ways in which innovation occurs (clustered and wave-like; collective; uncertain; and cumulative² ) in order to understand what must be done to generate long run growth which is both ‘smart’ and ‘inclusive’. It fundamentally seeks to both understand what has gone wrong and how to repair those failings. We will first look at the role that innovation has played as the driver of economic growth since the start of the Industrial Revolution, using the long-term lens of technological regimes and paradigms (Dosi, 1988; Perez, 2002, 2010) to characterise the current transition period in its historical context. These insights enable us to understand that the challenge today is not to ‘fix’ finance while leaving the economy sick, but rather to change the way that the real economy works. This change must include de-financialising the economy and redirecting investments towards productive mission-oriented areas.

We argue that the way to get the real economy to operate in the current context is to employ a policy direction that is smart, inclusive and green. ‘Green growth’ can become the next big technological and market opportunity, stimulating and leading private and public investment. This brings us to a discussion on the that the government plays in ensuring that such opportunities exist, and particularly the importance of being able to invest – welcoming the underlying risk and uncertainty – along the entire innovation chain, not only in areas characterised by positive externalities (such as research and development (R&D)). We then offer some criteria for specific fiscal/tax policies in order to achieve such a reorientation (making it more profitable for productive investments and less profitable for speculative ones), and for creating the ‘smart’ governance necessary to implement such policies. Without smart government at the organisational level, smart (innovation-led) growth is impossible. We look at the effect that such policies have on steering missions and promoting more inclusive growth, where the State not only socialises risks but also rewards. We argue that such policies are themselves innovation policies and conclude by summarising eight key criteria that we believe can help growth policy be guided by long-run value creation.

"Could technology make natural resources a platform for industrialization? Identifying a new opportunity for Latin America (and other resource-rich countries)"

Perez, C. (2016). In Noman, A. and J. Stiglitz (eds.) Efficiency, Finance, and Varieties of Industrial Policy. New York: Columbia University Press. Ch. 11.

Available as Working Paper: The new context for industrializing around natural resources: an opportunity for Latin America (and other resource rich countries)?

Abstract